Sometimes — homeowners insurance may cover AC repair, but only when the damage is caused by a sudden and accidental event rather than normal wear and tear. Insurance is designed to protect you from unexpected losses like storms, fire, or vandalism — not routine system aging. That means many everyday breakdowns aren’t covered, but certain incidents absolutely are. Understanding the difference helps avoid surprises when filing a claim.

Snapshot: What Texas Homeowners Should Know

| Category | Details |

| Typical AC Lifespan | 10–15 years in Texas heat |

| Average Repair Cost | $250–$1,200+ depending on parts and labor |

| Coverage Usually Applies | Storm damage, fire, lightning, falling debris, vandalism |

| Coverage Usually Does NOT Apply | Wear and tear, lack of maintenance, improper installation, flooding |

| Local Insight | Gulf Coast storms are a common source of covered AC damage |

When Homeowners Insurance Covers AC Repair

Insurance companies cover events that are sudden, accidental, and out of your control. If your AC was damaged by one of these events, you may be eligible for repair or replacement coverage.

1. Weather‑Related Damage

Texas storms can be rough on outdoor AC units. Wind‑blown debris, hail dents, or lightning‑related failures may qualify as covered incidents depending on the policy. If your condenser coils are crushed or the system stops working immediately after a storm, it’s worth contacting your insurer.

2. Fire or Smoke Damage

If your HVAC system is damaged during a house fire or electrical fire, homeowners insurance typically covers repair or replacement — because fires fall squarely into the “sudden and accidental” category.

3. Falling Objects

Tree limbs, fencing, or roof material sometimes fall during severe storms. When this type of physical damage strikes your AC system, the event is usually covered under standard policies.

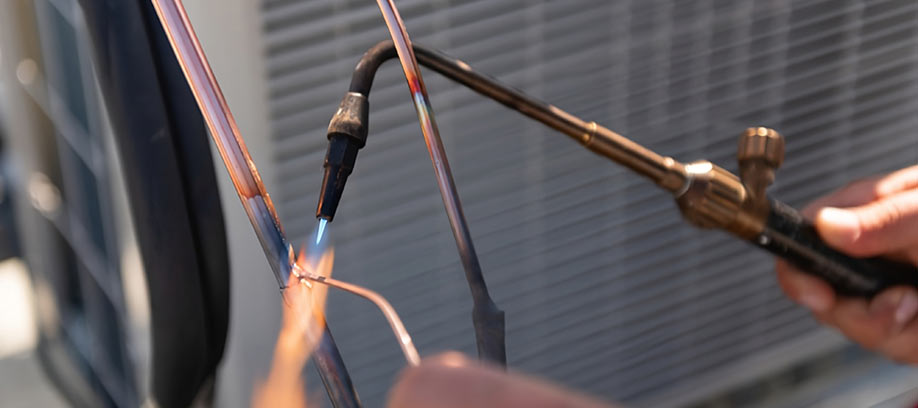

4. Theft or Vandalism

Although rare, AC units can be vandalized or stripped for copper. Most insurers require a police report and photos to process the claim. Once documentation is provided, vandalism normally qualifies as a covered loss.

When Homeowners Insurance Does NOT Cover AC Repair

Insurance adjusts claims carefully because regular HVAC wear is considered the homeowner’s responsibility. Claims are usually denied if the issue is caused by age or lack of upkeep.

1. Wear and Tear

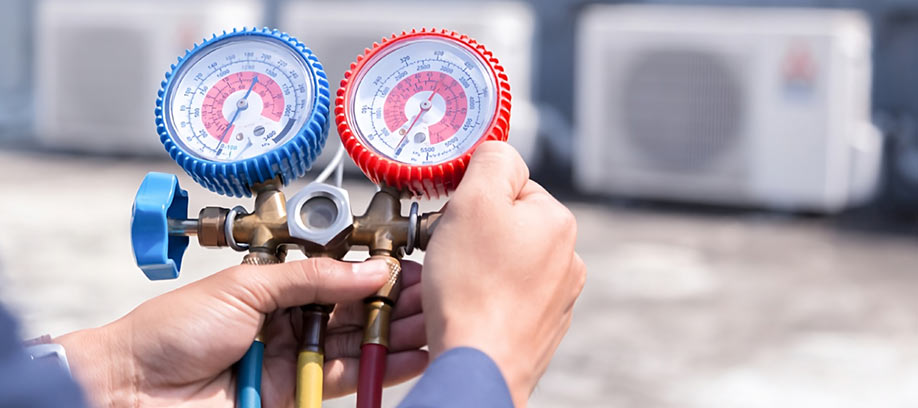

Systems naturally degrade over time. A compressor failure, refrigerant leak, or electrical breakdown from aging equipment is not considered an insurable loss. These are classified as maintenance or replacement‑related expenses.

2. Poor Maintenance or Neglect

If clogged filters, dirty coils, or ignored warning signs lead to damage, insurers may deny the claim. Maintenance is expected as part of homeownership — especially for systems that run heavily in Texas summers.

3. Flood Damage

Standard insurance policies do not cover flood‑related loss. Separate flood insurance is required for protection from rising water or storm surge.

4. Pest Damage

Animals chewing wires or nesting inside the unit are usually excluded unless your policy specifically states otherwise.

Home Warranty vs. Homeowners Insurance — What’s the Difference?

This is a common point of confusion. Insurance covers sudden, accidental events such as storms or fire. A home warranty covers equipment failures caused by normal, everyday use. If your older AC system simply stops working, a warranty may help where insurance will not. Both can be helpful — but they do very different jobs.

What Affects Whether a Claim Is Approved?

- The cause of the damage — sudden accident vs. slow wear

- The age and condition of the HVAC system

- Whether maintenance can be documented

- Policy type, deductibles, and exclusions

Step‑by‑Step Guide: Filing an AC Insurance Claim in Texas

- Take photos and videos of the damage as soon as it happens.

- Turn the system off to prevent additional damage.

- Call your insurer to confirm whether the situation is covered.

- Schedule a licensed HVAC inspection for documentation.

- Submit estimates, photos, reports, and any required police documentation.

- Meet with the insurance adjuster if they request an on‑site visit.

- Approve repair or replacement once the claim is cleared.

Current Trends and Local Outlook

Gulf Coast and Houston‑area homeowners are seeing more storm‑related AC claims due to severe wind and hail events. At the same time, parts and refrigerant costs have increased — which means claims may be larger than in the past. Many insurers are also paying closer attention to maintenance history when reviewing HVAC‑related claims, so keeping records has become more important.

FAQs

Does homeowners insurance cover AC compressor failure?

Insurance only covers compressor failure when the damage is caused by a covered event, such as a power surge or lightning strike. If the compressor wore out over time or failed due to lack of maintenance, the claim will almost always be denied. That’s because insurance policies treat normal aging and mechanical wear as homeowner responsibility rather than insurable loss. Always provide full documentation when filing a claim.

Will insurance replace my entire AC unit?

Yes — but only when the damage is severe enough that repair is not possible or not cost‑effective. In those cases, insurers may approve full system replacement as part of the claim settlement. If the problem can be fixed with a repair, insurance generally only pays for the damaged components. Your deductible also applies before coverage begins.

Are window AC units covered under homeowners insurance?

Window AC units are usually covered as personal property rather than part of the main HVAC system. Whether they’re covered — and for how much — depends on the cause of damage and the details of your policy. Sudden accidental events are most likely to qualify. Wear‑and‑tear failures are still excluded even for window units.

Does insurance cover refrigerant leaks?

Most refrigerant leaks are caused by corrosion or long‑term deterioration, which means they aren’t covered. However, if the leak happens because of storm impact or physical damage, the repair may qualify under your policy. Your HVAC technician’s written report plays an important role in determining eligibility. Always share that report with your adjuster.

Do I need proof of maintenance for an HVAC‑related claim?

Having maintenance records can significantly improve your chances of a claim being approved. Insurers want to see that the system was properly cared for and that neglect didn’t contribute to the failure. Receipts for annual tune‑ups, filter replacements, or prior repairs all count as helpful documentation and reduce the risk of denial.

Why Texas Homeowners Trust John Moore HVAC Services

For over 50 years, John Moore HVAC Services has helped Texas homeowners handle AC failures, storm‑damage inspections, insurance‑related repairs, and system replacements. Our licensed technicians provide clear diagnostics and honest recommendations — so you understand exactly what happened and what your options are. If your AC was damaged unexpectedly, we’re here to help you move forward with confidence.